What You Need to Know About Garnishment Exemptions

by John G. Merna, Esq.

by John G. Merna, Esq.

Introduction: What is a Garnishment?

A garnishment is a legal process that allows judgment creditors to collect money from the judgment debtor’s wages, bank account, or other assets. The creditor must first sue the debtor and obtain a judgement, which is basically the court’s confirmation that the debt is owed. With the judgment the debtor can obtain a court order to begin garnishing by submitting a “Garnishment Summons”.

WARNING: Asserting an exemption does not stop the garnishment or reverse the judgment. Exemption any asset, if approved by the court, is limited strict to that asset or to the applicable limit of protection. Example: Under the homestead deed exemption you can protect up to $5000 per person in any property and an additional $500 per qualified dependent. This protection doubles at the age of 65 (see below).

What is a Garnishment Exemption?

Garnishment exemptions are laws that protect a person’s property from being taken by creditors. There are both federal and state garnishments that can be asserted. In Virginia, there are many types of garnishment exemptions, the most common being a homestead exemption. These exemptions laws allow you to “exempt” or protect certain assets from garnishment. Most commonly this includes wages and savings. Some of the exemptions, however, have a limit. You can see a list of Virginia exemptions that are available on this page. Since many are not applicable to everyone we will review the most commonly used.

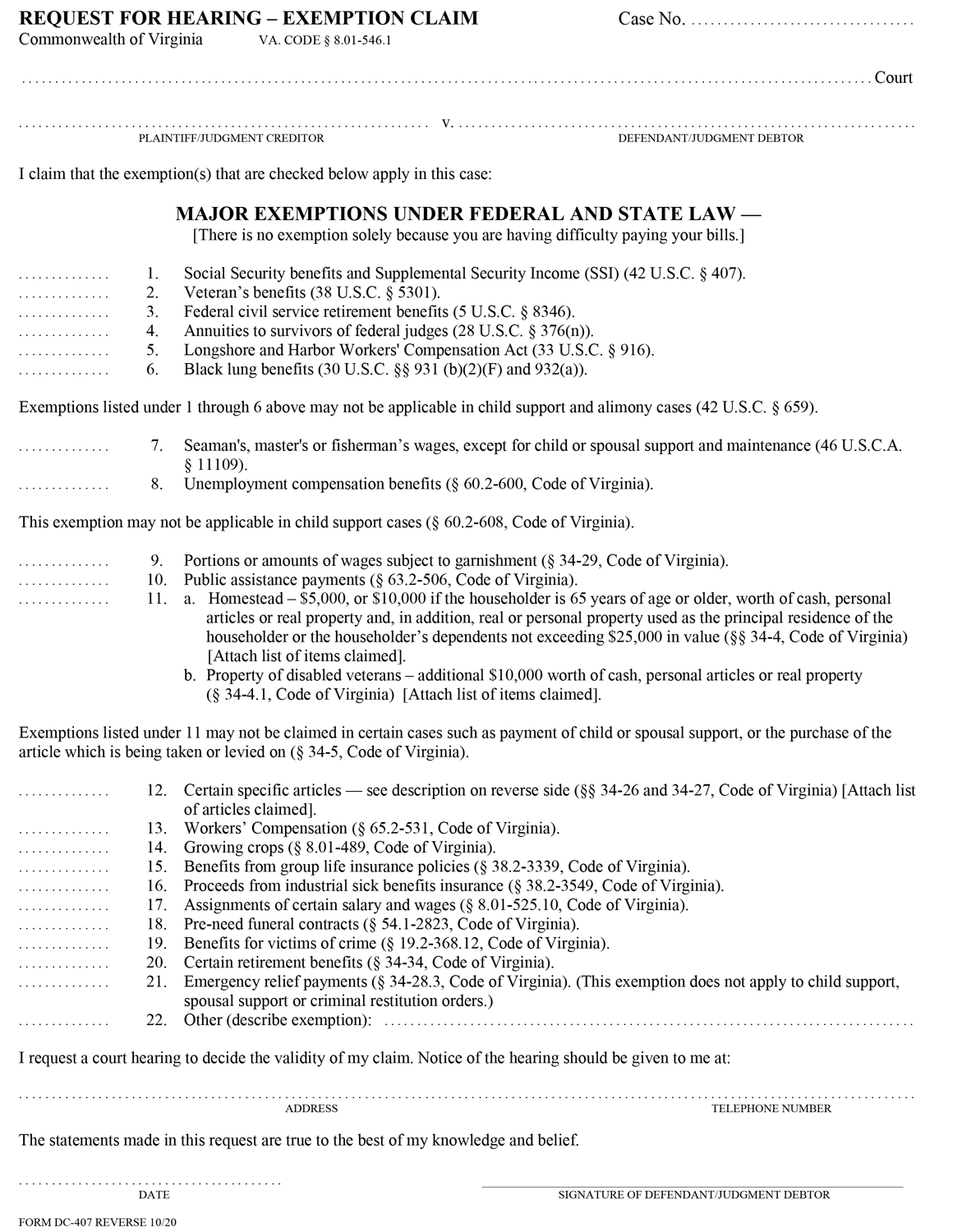

How Do I Apply For a Garnishment Exemption?

To apply for an exemption to being garnished you must first “assert” your exemption by filing a Request for an Exemption Hearing (Form DC407) in the court where the garnishment order was issued. On this form you have to list the judgment title, case number, court, and select the exemption or exemptions you are claiming. You must apply for the exemption hearing before the hearing date listed on the garnishment summons!

TIP: If you become aware of a garnishment that was sent to the wrong employer or bank there is no need to rush and file for an exemption since nothing has been garnished.

Can I Exempt My Wages or Savings Because I Will Have Difficulty Paying My Bills?

Unfortunately, no. Financial hardship alone will not protect your money from being garnished. The underlying idea of exemptions is that a group of protections have been enacted on the state and federal level to protect sources either because they threaten to make the person homeless. For instance protecting retirement and social security benefit. This idea of minimum protect historically evolved as the English system of law realized debtor’s prison and indentured servitude were inhumane and excessive penalties for failing to pay a debt.

Can I Exempt Money I Am Expecting Such As Future Pay?

The answer to this is a little tricky. Technically, you can’t exempt anything that has not been “attached” or garnished. For instance, if your bank account has been frozen you can exempt what was in there and held but you cannot exempt in advance all the money that will be going into the account over the next year. The same is true for wages. You can only exempt the amount withheld up to the time of the Exemption Hearing.

When Do I Have To File For The Garnishment Exemption?

IMPORTANT: You must file to exempt the funds or property prior to the hearing (Return Date) listed on your Garnishment Summons. If you do not it is too late to assert your exemption and the funds and/or property will be turned over to the creditor. You do not have to wait until the return date to apply for the exemption. There is no hearing on that date unless you file in advance for an exemption hearing.

Conclusion:

It is important you understand the exemption rules and process before you file for a wage garnishment exemption. This includes understanding both the timing of when to file for an exemption and other steps, like filing a homestead deed, that might be involved.

If you have a question about being garnished or recovering garnished property or wages, the attorneys at Merna Law will speak to you at no charge. Give us a call today.

What Are Some More Common Exemptions To Protect Property From Garnishment?

Here are the major exemptions under federal and state law that are available to protect property.

- 1. Social Security benefits and Supplemental Security Income (SSI) (42 U.S.C. § 407)

- 2. Veteran’s benefits (38 U.S.C. § 5301) This includes military retirement and disability. It does not include wages.

- 3. Federal civil service retirement benefits (5 U.S.C. § 8346)

- 4. Annuities to survivors of federal judges (28 U.S.C. § 376(n))

- 5. Longshore and Harbor Workers’ Compensation Act (33 U.S.C. § 916)

- 6. Black lung benefits (30 U.S.C. §§ 931 (b)(2)(F) and 932(a)).

- Exemptions listed under 1 through 6 above may not be applicable in child support and alimony cases (42 U.S.C. § 659)

- 7. Seaman’s, master’s or fisherman’s wages, except for child or spousal support and maintenance (46 U.S.C.A. § 11109)

- 8. Unemployment compensation benefits (§ 60.2-600, Code of Virginia). This exemption may not be applicable in child support cases (§ 60.2-608, Code of Virginia)

- 9. Portions or amounts of wages subject to garnishment (§ 34-29, Code of Virginia) This is a tricky one. This protect an amount equivalent to 40 x the federal minimum wage per week. (At the time of this writing the federal minimum wage was $7.25.) In other words, if you make less than $290 per week you are not legally garnishable. However, if your payroll is not aware of this exemption you may have to request an exemption hearing to recover any money taken.

- 10. Public assistance payments (§ 63.2-506, Code of Virginia)

- 11. Homestead Exemptions

- a. Homestead – $5,000, or $10,000 if the householder is 65 years of age or older, worth of cash, personal articles or real property and, in addition, real or personal property used as the principal residence of the householder or the householder’s dependents not exceeding $25,000 in value (§§ 34-4, Code of Virginia) [Attach list of items claimed].

- b. Property of disabled veterans – additional $10,000 worth of cash, personal articles or real property (§ 34-4.1, Code of Virginia) [Attach list of items claimed]. Exemptions listed under 11 may not be claimed in certain cases such as payment of child or spousal support, or the purchase of the article which is being taken or levied on (§ 34-5, Code of Virginia). Additionally, the homestead exemption can be waived by contract.

- WARNING: To Assert your homestead exemption you must file a valid Homestead Deed setting (VirginiaHomesteadDeed.com) setting apart the asset you wish to protect and filing it in the proper jurisdiction which generally is where you reside or the property is located. Check to see if you have waive the homestead exemption prior to filing a homestead deed.

- 12. Certain specific articles ––(§§ 34-26 and 34-27, Code of Virginia) [See list]

- The family Bible;

- wedding and engagement rings;

- family portraits and family heirlooms not to exceed $5,000 in value;

- a lot in a burial ground;

- all wearing apparel of the householder not to exceed $1,000 in value;

- all household furnishings including, but not limited to, beds, dressers, floor coverings, stoves, refrigerators, washing machines, dryers, sewing machines, pots and pans for cooking, plates, and eating utensils, not to exceed $5,000 in value;

- firearms, not to exceed a total of $3,000 in value;

- all animals owned as pets, such as cats, dogs, birds, squirrels, rabbits and other pets not kept or raised for sale or profit;

- medically prescribed health aids; tools, books, instruments, implements, equipment and machines, including motor vehicles, vessels, and aircraft, which are necessary for use in the course of the householder’s occupation or trade not exceeding $10,000 in value, except that a perfected security interest on such personal property shall have priority over the claim of exemption under this part (“occupation,” includes enrollment in any public or private elementary, secondary, or vocational school or institution of higher education);

- motor vehicles, not held as exempt as necessary for use in the course of the householder’s occupation or trade owned by the householder, not to exceed a total of $6,000 in value, except that a perfected security interest on a motor vehicle shall have priority over the claim of exemption under this part;

- those portions of a tax refund or government payment attributable to the Child Tax Credit or Additional Child Tax Credit pursuant to § 24 of the Internal Revenue Code of 1986, as amended, or the Earned Income Credit pursuant to § 32 of the Internal Revenue Code of 1986, as amended;

- unpaid spousal or child support.

- 13. Workers’ Compensation (§ 65.2-531, Code of Virginia)

- 14. Growing crops (§ 8.01-489, Code of Virginia)

- 15. Benefits from group life insurance policies (§ 38.2-3339, Code of Virginia)

- 16. Proceeds from industrial sick benefits insurance (§ 38.2-3549, Code of Virginia)

- 17. Assignments of certain salary and wages (§ 8.01-525.10, Code of Virginia)

- 18. Pre-need funeral contracts (§ 54.1-2823, Code of Virginia)

- 19. Benefits for victims of crime (§ 19.2-368.12, Code of Virginia)

- 20. Certain retirement benefits (§ 34-34, Code of Virginia)

- 21. Emergency relief payments (§ 34-28.3, Code of Virginia). (This exemption does not apply to child support, spousal support or criminal restitution orders.)

- 22. Other less common exemptions.